Buffer Pitch Deck

If you need to raise funding from a VC for your startup, the initial step is to craft a pitch deck. An investor pitch deck is a brief presentation that

helps investors to understand your business. It should necessarily include your product benefits, your business model, your monetization strategy,

introduction to your team, and your plan to acquire users.

A pitch deck is a vital fundraising tool that helps you get investor attention - be it just $50,000, $500,000, or a whopping $50 million.

Pitch decks usually run for fifteen to twenty slides.

And although presentations are a short, concise form of your entire story, creating one isn't an easy task. It's another thing if you've done it before.

But if it's your first time, and you're a first-time entrepreneur, it can prove to be incredibly daunting.

To help you with this daunting task, we at Pitch Deck have taken cues from top startups who've raised money from angel investors and VCs with effective

pitch decks and went ahead with redesigning them. While you can check out these redesigned pitch decks for inspiration, you can also use these templates

as a base for your cake.

“ We want everyone to have a great experience building their pitch decks — and with Pitch Deck they get just that”

What does the Buffer Pitch Deck entail?

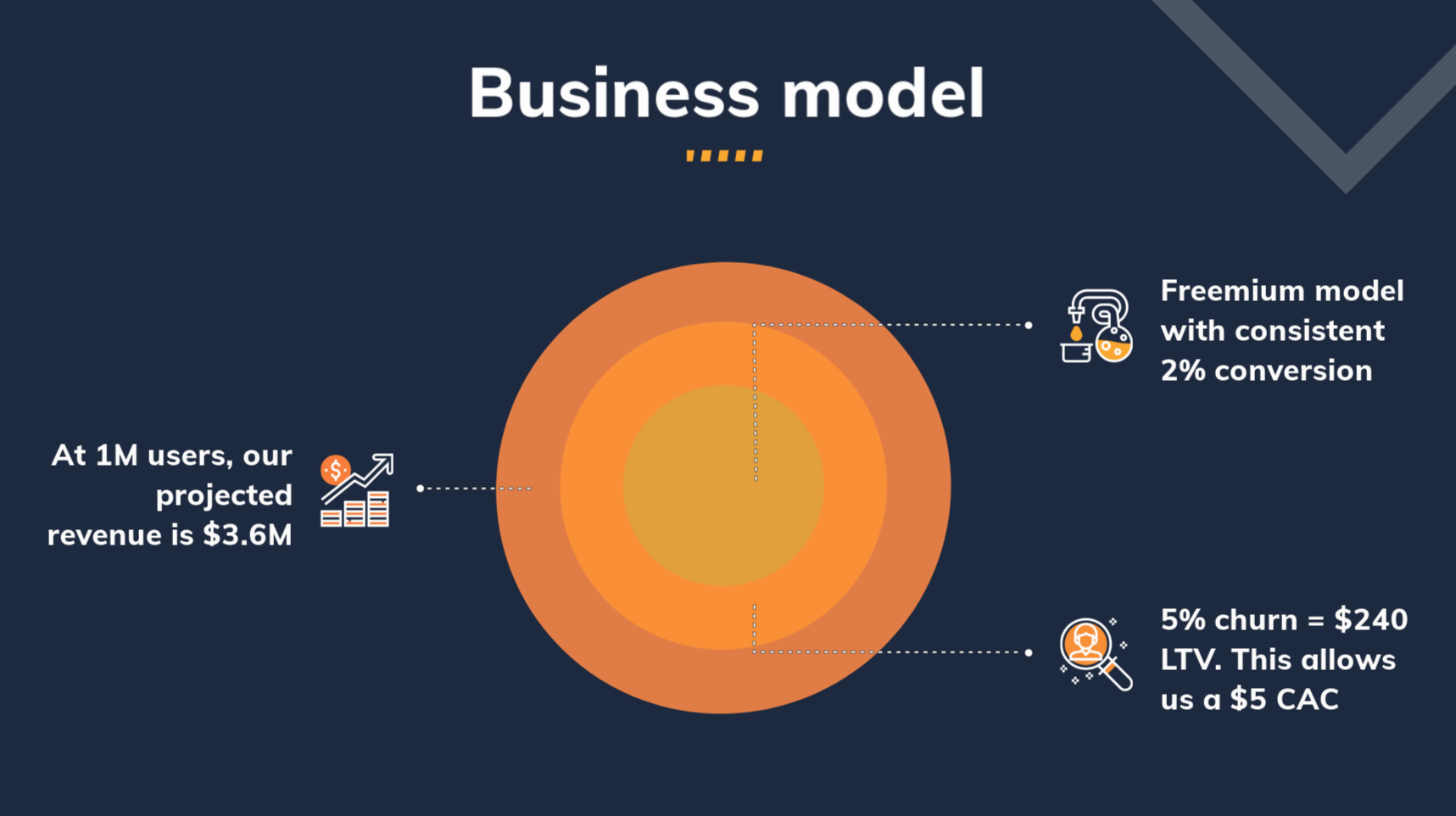

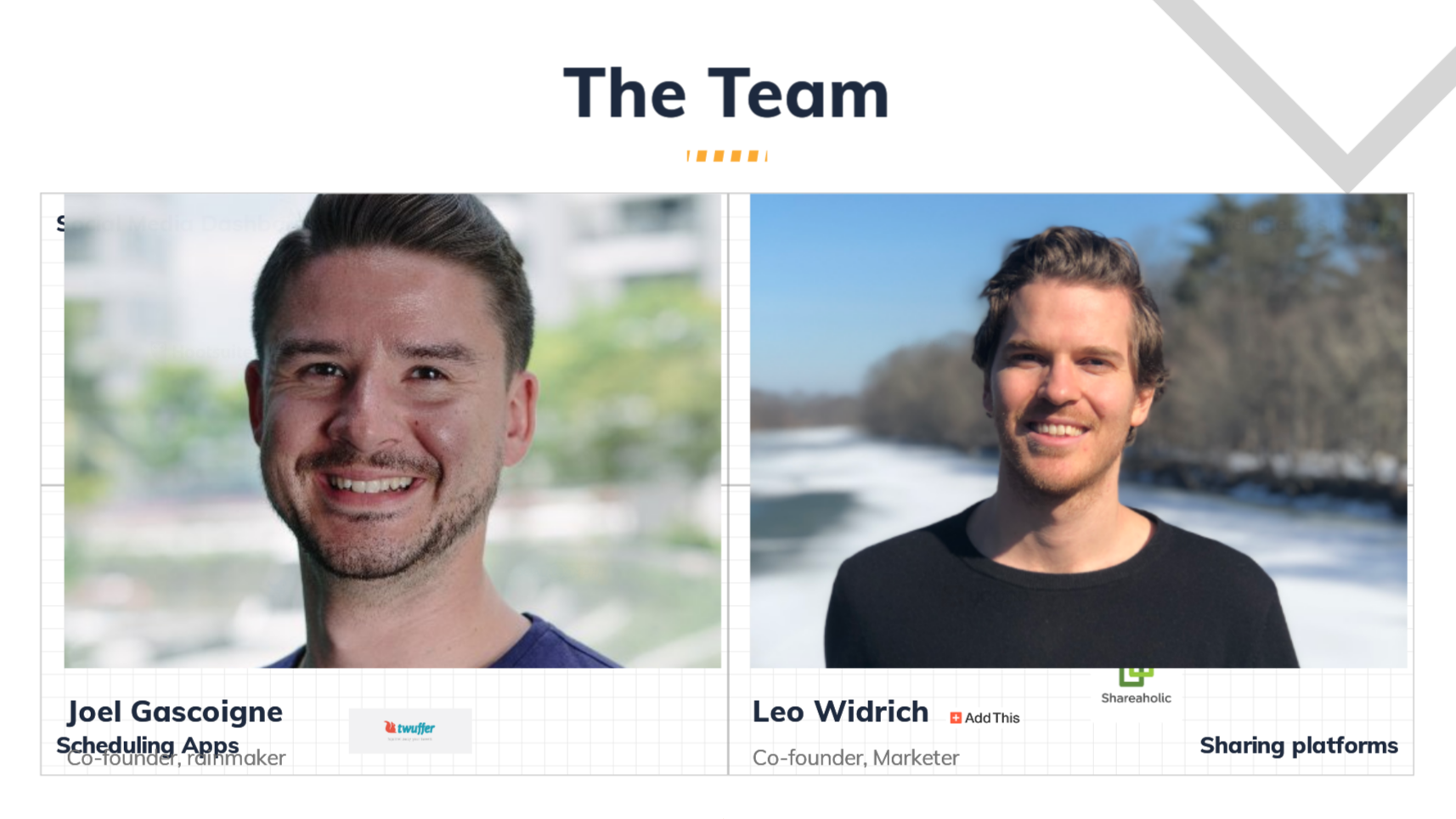

Buffer was founded in 2010 and is one of the most successful and well-known SaaS start-ups today. The team raised an initial USD 400K round of funding

in 2010, which they used to grow the company up to a $60M valuation for the Series A financing in Oct-2014. Early traction and cash flow positive were

key variables to Buffer's success.

Now, as much as we love Buffer, we at Presentations. AI have several questions regarding the thought behind the design of their Pitch Deck. For

instance, the competitive landscape slide from their original deck is very confusing. When you email such investor pitch deck out, and you always will,

investors will see this and not understand your competitive landscape and think that you have no understanding of whom you are competing against.

Moreover, chances are Investors may also overlook you because your market looks way too big and you are going to get washed out or ignored inevitably